As a small business owner and experienced financial professional I have learned a lot. If you are working on the financial side of your business, read the tips below. In my experience, these are the 10 Do’s & Don’ts of Accounting ALL business owners should know and practice. Regardless of size or industry.

Do’s

1. Get an accountant

I cannot emphasize this enough. If you don’t have one yet, get yourself an accountant. It’s all about finding the right person. Make sure that their skill set matches your specific needs. For small start-ups you’ll need just the basic bookkeeping services. For more established, larger businesses a more advanced accounting service, one that provides sophisticated financial reporting, is the way to go.

2. Ask for recurring reporting

I’ve met many business owners who do not look at financial reports. They have a traditional bookkeeper who organizes the books and sends their invoice. That’s it. The problem is you’re missing a vital step in the process: Analysis. Financial Reporting shows you what’s really going on behind the scenes of your business. For our clients we like to sit down with them (virtually) each month and discuss prior month’s performance and compare to last year’s. We also discuss forecasts, budgets, and any unexpected costs to manage in the near future.

3. Connect your accountant with 3rd parties.

Do not leave your accountant in the dark when it comes to the whole financial picture of your company. Introduce your CPA’s, bankers, and accountants to each other, it will establish a cohesive financial picture.

4. Build processes that scale with your business

Stay away from manual processes as much as possible. Automate. Automate. Automate. Always think, “Will this process work if we were twice the size we are now?” This tip works for all aspects of business. Growth can happen fast and you will find yourself in outdated processes quickly if you don’t prioritize efficiency from the get go. Let’s not reinvent the wheel each time we want to do something repetitive like on-boarding a new client or employee. The truth is you could miss out on clients or customers if you lack efficient processes—let’s avoid that. Are you looking to go more in depth on your business’s processes? Read this article by Entrepreneur to learn 11 Ways to Automate Your Business and Boost Efficiency. Build your processes for tomorrow, not just now.

5. Seek the guidance of key members on your team when making large financial decisions

We have a client that does a really good job at this. They bounce ideas off their team to see what they think and if there’s anything he’s missing or forgetting. Our clients are strategic, calculated, and smart when it comes to large financial decisions. After they’ve consulted us, they go straight to their team. Mentors and coaches are great people to consult with too. This tip prevents you from being reactive or impulsive. You have a great team of people behind you that want to see you succeed, so use them!

Dont’s

1. Do not do the accounting yourself.

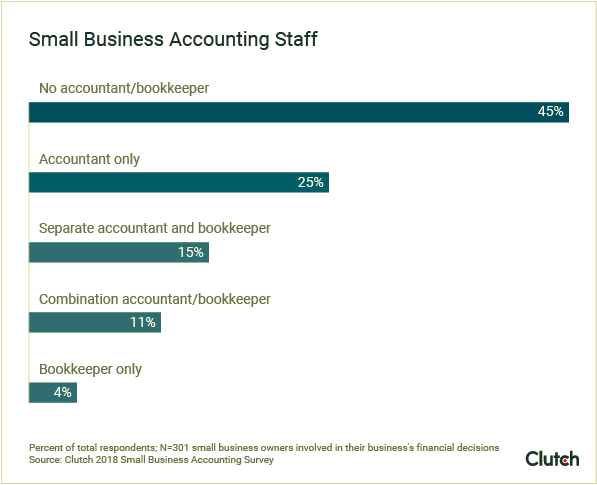

In a survey of 300 small business owners conducted by Clutch, it was found that nearly half of small businesses (45%) do not employ an accountant or a bookkeeper. Business owners are smart and gritty individuals. Which typically means you want to do it all yourself. You may be thinking you’re saving time and money by not hiring someone. But the truth is that you are doing the exact opposite. Your time is valuable and best spent elsewhere. Find a solid, basic, and inexpensive accountant or outsource it to a company like ours. Let us do the dirty number work for you. That’s what we’re good at.

2. Do not take out any debt or loans without a cash flow plan.

If you are a small business in debt, you are not alone. 70% of small businesses have outstanding debt. Without a plan you will burn through money faster than you think. A cash flow plan maps out what you need, to have a successful borrowing experience. Debt and loans do not have to be a scary thing. With the right plan you’ll be able to manage debt easily. With our clients we do cash flow projection or a source and uses statement in the planning process. Our clients know that with our cashflow plan their decision to borrow is secure.

3. Don’t be inconsistent with finances.

If you have a plan, budget, or process, follow it. Always! That consistency alone will breed habits for you and your team to follow together. With our experience the business owners who take responsibility for their finances are the most successful. It takes discipline and accountability but the pay-off is enormous.

4. Don’t be afraid to raise prices.

There can be a lot of emotion that plays into this one. Fear. Self-worth. Anxiety. Fact of the matter is if you’ve been with your clients for more than 1 year, you are probably doing a great job and they are grateful for your work. As time goes on and your experience with the client builds, you are delivering a more sophisticated service to them. Own your exceptional work and raise your prices.

5. Don’t wait too long to hire help.

Whether it’s entry or executive level, don’t wait too long to hire someone. In a survey of 200 recruiting professionals Yello found that the average time to find a new hire is 3-4 weeks. However, as small business owners we know that timeline can get much longer. (Especially if you lack an employee dedicated to recruiting.) This is where your cash flow can help you plan ahead. Align your hiring goals with your finances to experience a seamless hiring process. We include this in our client’s financial forecast at the beginning of the year. It’s a great way to think ahead and avoid the messiness that comes with impulsive, reactionary hires.

Implement these 10 tips in your small business and feel more confident, clear, and productive about your finances. Need help implementing them? Reach out to us! We love helping small businesses thrive.